Maybe it was the heat, maybe the beer. But when the bear tromped out, we all lost our minds.

Known by some as Sascha, Theodore (Theo or T.H., for short), and simply Mr. Bear to his creator, the Hamm’s mascot remains one of the most recognizable icons in Minnesota beer. So Mr. Bear’s presiding over the official declaration of Minnesota Beer Day, hosted by the Minnesota Craft Brewers Guild on September 27 at St. Paul Brewing, felt fitting.

“For the record, Molson Coors’s legal OK’d this,” Bob Galligan, director of government and industry relations for the Guild, told the assembled crowd of state officials, media, and staff from a couple dozen breweries.

Per the proclamation, Minnesota Beer Day will take place on November 1 beginning this year to celebrate the contributions of all those involved with producing and serving beer in the state. The Guild will release a special pint glass on Friday to coincide with a number of celebrations at breweries and brewpubs.

Officially, the date coincides with Grain Belt’s founding in 1850. But Jess Talley, the Guild’s executive director, noted a more strategic reason.

“For our breweries and brewpubs, things generally wind down in the winter,” Talley says. “Hosting this day to celebrate all across the state is really a way to get people out, talking about craft beer, hopefully drinking craft beer in these breweries at the start of that slow season, and reminding them that these businesses are here all winter creating marvelous stuff.”

Last winter was notably difficult for breweries. Several closed for good. Others pleaded for help. And Fair State Brewing Cooperative’s Chapter 11 bankruptcy sounded the loudest alarm bell, causing statewide uncertainty about which, if any, breweries were safe.

Fair State emerged stronger after restructuring its debt and is now out of bankruptcy. Yet while the sky-blue waters seem to have calmed, one notable collapse can restart the speculation cycle. Case in point: the July announcement that Finnegan’s Brew Co. would be abandoning its taproom and shifting to contract manufacturing and a “residency” with Fulton Beer.

So as Minnesota Beer Day approaches, what kind of beer scene are we celebrating? Is it one in decline, one returning to its former glory, or something different that’s not yet fully formed? Is the long-rumored "craft-beer bubble" at risk of popping, assuming it's even a real thing?

Let's find out.

Pint Charts

The Land of 10,000 Lakes is home to 237 craft breweries. That’s the 15th most in the U.S., according to the most recent numbers from the Brewers Association. These generate:

- 11,257 jobs statewide in craft beer

- 525,333 barrels total annual production

- $1.9 billion total economic impact

Recently, I attempted to contact every brewing operation across the state for a brief survey.

Forty-four breweries, about one in five, responded. While this doesn’t offer a complete picture, the data set includes breweries at nearly every level of production and is pretty evenly split between the Twin Cities metro and Greater Minnesota. It tells an interesting story about an industry in flux at a pivotal moment.

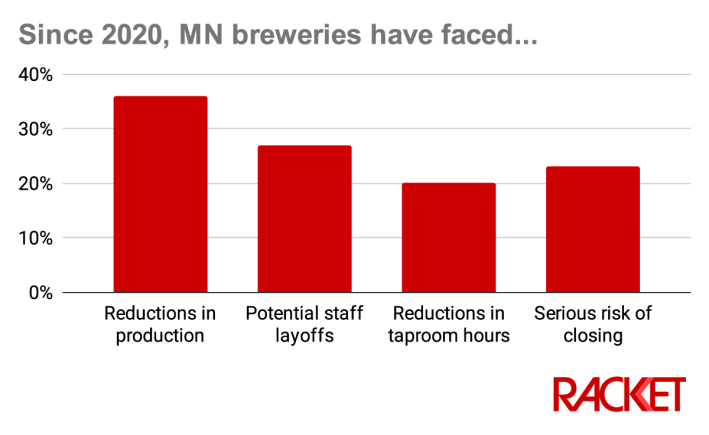

For starters, you can’t talk about the market today without acknowledging the impact of the COVID-19 pandemic. The responses highlight myriad challenges breweries have experienced since 2020. Probably most telling, nearly one-quarter of breweries faced serious risk of permanent closure in the last four years.

Many factors deserve some blame for craft beer’s rough stretch: a drop in beer sales, younger generations drinking less alcohol, rampant market saturation, or the rise of seltzers and THC-infused beverages.

Effectively responding to these is part of the job, according to Ariel Keeton, brewer at Excelsior Brewing Co.

“Even with some decline in breweries over the last couple of years, the industry is still strong in Minnesota,” Keeton says. “There are new breweries opening every year. People still have demand for our products.”

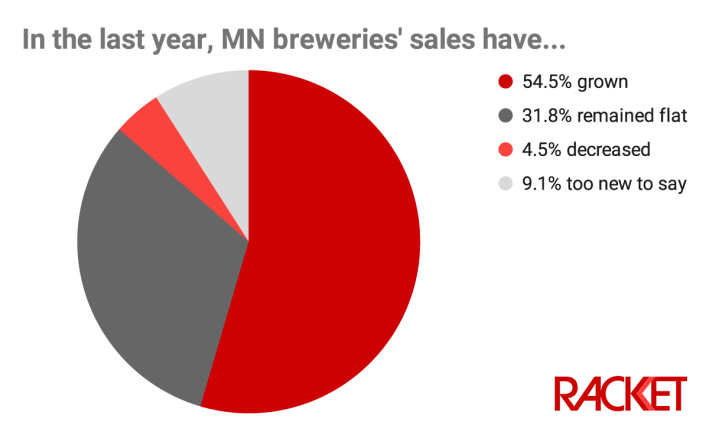

Most breweries have seen sales growth over the past year. The cost of brewing supplies and labor continue to rise due to inflation, and supply chain slowdowns remain.

While sales have kept pace with inflation at LocAle Brewing Co. in Mankato, the brewery remains stuck sustaining rather than exploring ways to expand, according to Jim Parejko, VP and head brewer.

“There is little left over for the business to go beyond paying bills to brew beer and keep the taproom open,” Parejko says. “The numbers do impact how we plan for the future. We are considering changing our business to focus on food or live music to draw in folks, but that has upfront costs that make the decision difficult.”

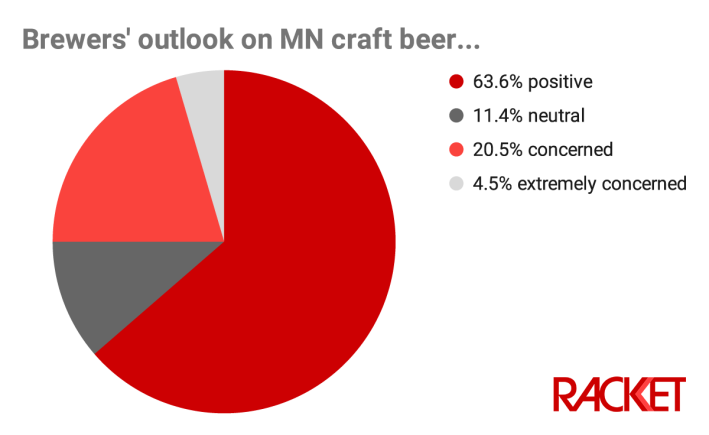

This leads to a truly Minnesotan attitude on the market in general: “Eh, it’s not so bad.” Two-thirds indicated their outlook on Minnesota craft beer was positive.

“Overall, my outlook is positive for Minnesota craft beer,” says Brian Carlson, owner and general manager of River Siren Brewing Co. in Stillwater. “I am concerned when I hear about once pinnacle breweries closing their doors, but we continue to see strong demand.”

It may be worth noting that “extremely positive” was an option, but no one selected it. Or it may not. Behind the scenes, brewery owners understand that the deck is always stacked.

“Owning a brewery is tough,” says James Ewen, co-founder and director of brewing operations at Wooden Hill Brewing Co. in Edina. “It's people-heavy. There's a high cost to enter and maintain it. And you're at the mercy of public opinion.”

Investing in benefits for workers, saving for emergency repairs, and engaging customers via social media and email marketing have worked well for Wooden Hill. The brewpub added a major expansion to its taproom in recent years and continues to evolve its food menu.

“At the end of the day, we are in the hospitality business,” Ewen says. “That can be a very fun and rewarding business to be in, so we do our best to bring that energy into everything we do.”

The Outstate Debate

The assessment remains incomplete without a regional breakdown. The brewery teams had plenty of downside about operating in the Cities: high rents, competition for customers, and greater labor costs. But in the end, brewing operations outside the seven-county metro seemed to fare worse:

- Metro breweries reported a 76% positive outlook compared to Greater Minnesota breweries’ 52%.

- While a quarter of breweries statewide had faced closure, the outstate rate was closer to one-third.

- Subjectively, a slight majority of both metro (52%) and Greater Minnesota (61%) breweries believed running a brewery outside the Twin Cities was more difficult.

To draw in those staying in more and spending less, Fat Pants Brewing Co. in Eden Prairie has focused on food with takeout and delivery options, THC-infused beverages, and general experience, according to Creative Director Michael Anderson. But that only works if you have a broad pool of potential customers.

“We feel we do well because we are seated towards the edge of the metro area, making us one of only a few options for our more local customers, while still being within the reach of the large market of craft beer lovers that the metro provides on a cultural level,” Anderson says.

The cheaper rent or the ability to purchase a building in Greater Minnesota is also offset by limited talent and difficulty staffing day shifts, according to Chris Larson, CEO and head brewer at Tilion Brewing Co. in Cannon Falls.

“We have had an assistant brewer position open for about a year with no qualified applicants,” Larson says. “Additionally, it is harder to stand out, and we have to work harder to stay there. Self-distribution is harder, as the long distances take up more of your work week.”

Operating in the Twin Cities metro provides quick access to ingredients, equipment, and maintenance help, Ewen adds. “When there are multiple breweries nearby it's pretty easy to drop off that extra bag of wheat someone forgot to order or make a quick pickup at [brewery supply wholesaler] BSG,” he says.

Whether metro or outstate breweries have it harder was the most griped-over question in the survey. But most of those who responded focused on the unique difficulties of what each brewery is trying to achieve in its particular location.

“Both areas have their own challenges, and I only picked Greater Minnesota because there are less of us out here,” says Marty Czech, co-owner at Pantown Brewing Co. in St. Cloud. “We don't get the same kind of support from the Guild or other breweries as the MSP breweries do.

“But we get strong local support from our communities,” Czech adds. “Many times our communities can claim one specific brewery as theirs, where in MSP you sometimes have three or more in the same neighborhood.”

High Stakes

Another area where the geographical location plays a major role is in THC-infused beverages.

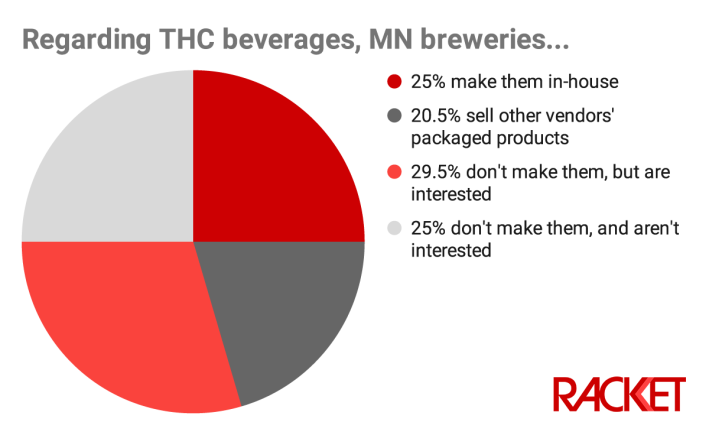

The results showed that statewide, a quarter of breweries make these drinks in-house, and just over 20% sell other vendors’ products. Another quarter don’t yet make them but are interested. The remaining 29.5% don’t make them and aren’t interested.

Breweries outside the metro showed greater skepticism. However, of the breweries that make THC drinks in-house, 73% reported sales growth where the others had mixed financial results.

Kyle Sisco, CEO of Venn Brewing Co. in Minneapolis, notes that the house-made Zenn Enlightening THC Tonics account for upward of 30% of sales. To keep up with demand, Venn has built out a production brewing facility (working with ubiquitous brewery contractor James Lee).

“THC beverages aren't going anywhere. The public has been waiting for them for an eternity,” Sisco says. “It's only going to become more popular.”

For others, the numbers typically add up to a few percent of sales. In a retail setting, some recognizable brands that produce at high volumes have claimed outsize market share. So the products are largely a way to make the taproom experience more inclusive.

The impact of cannabis beverages was a major topic at the MN Brewers Conference in March. But the continued lag in adoption recalls another point from the keynote. Many times, breweries miss or resist trends, according to Scott Metzger, president and COO of Hawaii-based Craft ‘Ohana.

“Let's be honest: A lot of you in this room probably talked a lot of shit about hazy IPA when it was getting off the ground,” Metzger said. “Then you started drinking some, and then you saw some sales data, and you were like, ‘This isn't so bad.’”

Now Minnesota is at the forefront of the THC boom. So why wouldn’t brewers cash in?

Or as Galigan put it back in March: “At the end of the day, we are brewers, obviously beer is first and foremost. But there's no point in denying that the market is changing.”

Approaching Equilibrium

In the keynote, Metzger broke down craft beer’s history into four distinct periods, an assessment that rings true:

- The Age of Pioneers: The early days when operations like Summit Brewing Co. began to pop up, alongside Sierra Nevada and Boston Beer.

- The Age of Heroes: From the mid-2000s through the passage of the 2011's Surly Bill and into the flood of pre-pandemic brewery openings.

- The Age of Disruption: Where we currently are, working to understand consumer habits and reset after the pandemic disruption.

- The Age of Equilibrium: Where the industry is headed, balancing out the extreme challenges since 2020 with the relative ease of the preceding era.

In short, the most unprecedented challenges hit at a time when business had been, generally speaking, easier than in most other industries, according to Metzger.

“The Age of Heroes got us in a bit of trouble because success came away too easy,” he explains. “Making good beer was all it took, and sometimes you didn't even need that. You just had to put an open sign up on your tap room and people were flooding in.”

Before COVID hit, breweries that closed often faced ongoing issues with quality, or the business side had difficulties. Today, even good breweries must remain vigilant of any slippage in quality, guest experience, community presence, and so on.

The days of triple-digit growth are gone. But the reality is that for every local beer maker facing defeat, many others are succeeding, Talley adds.

“In Minnesota, we are still opening more breweries than we are closing, which is not the case in a lot of places. In a lot of states, it's not the case at all,” she says. “We feel like Minnesota still has a lot of love to give to craft beer.”

So as Minnesota Beer Day approaches, the state of the industry may not be what it used to, but it’s shifting. There’s plenty of cause for optimism, according to Ben Hugus, founder of Ursa Minor Brewing in Duluth.

“While the industry is facing headwinds and unique challenges, the people making beer here are still passionate, nimble, and entrepreneurial,” he says. “I believe the clever and hard working people building breweries here in Minnesota will find a way to continue thriving long into the future.”

The survey respondents included: Bear Cave Brewing, Bent Paddle Brewing Co., Block North Brew Pub, BoatHouse Brewpub and Restaurant, Boathouse Brothers Brewing Co., Boom Island Brewing Co., Canal Park Brewing Co., Excelsior Brewing Co., Fairmont Brewing Co., Fat Pants Brewing Co., Gambit Brewing Co., Giesenbräu Bier Co., Gravity Storm Brewery, Haggard Barrel Brewing Co., Inbound BrewCo, LocAle Brewing Co., Lost Sanity Brewing, LTS Brewing Co., Mankato Brewery, Mineral Springs Brewery, Minnesota Beer Co., Minnewaska House Brewing Co., Outstate Brewing Co., Paddlefish Brewing Co., Padraigs Brewing, Pantown Brewing, Rendezvous Brewing, River Siren Brewing Co., Saint Paul Brewing, Take 16 Brewing Co., Thesis Beer Project, Tilion Brewing Co., Torg Brewery, Two Fathoms Brewing, Ullsperger Brewing, Uncommon Loon Brewing Co., Urban Growler Brewing Co., Ursa Minor Brewing, Venn Brewing Co., Waconia Brewing Co., Waldmann Brewery, Wandering Leaf Brewing Co., Wooden Hill Brewing Co., and Wooden Ship Brewing Co.