Welcome to Racket’s Money Journal series, where you can snoop on the finances of an anonymous Twin Cities neighbor. Interested in submitting your own? Email jay@racketmn.com for instructions on over-sharing the monetary details of your life! H/T to Refinery29 for pioneering a tremendous concept that we’re excited to localize.

Personal Information

Job: Part-time nonprofit executive assistant + going to grad school

Age: 41

Neighborhood: Kingfield

Education: Bachelor’s degree, almost done with a master’s

Salary: $36,500/year

Partner’s salary: Somewhere around $18,000/year

Dependents: N/A

Estimated net worth: $55,000

Debt

Credit cards: I put everything on one credit card but I pay it off basically every month, so currently $0.

Vehicle: My partner takes care of the car, which is beat up but paid off. That’s how we split things out: I do rent, utilities, he does food, toiletries and the car, then we sort of work everything else out around that.

School: $11K student loan—this I took out recently to partially pay for my school. I could have afforded to pay for all of school just with my savings (aka money from grandma), but… I’m gambling on the goddamn Democrats to do something for once so maybe it’ll just go away if they actually pass student loan debt forgiveness. Or I’ll be able to pay it off relatively quickly either from my incredible post-graduate job (sarcasm!) or from savings. Either way, it allows me to have something in savings at least for a time, so I feel more secure. This is the first loan I’ve ever taken out so it’s partly to build a credit history before (maybe) buying a house a few years down the road, and it has yet to earn any interest. If anyone in the comments wants to tell me this was a stupid idea, feel free!

Assets

Retirement accounts: Around $38,000 with two different former employer-sponsored accounts. At some point I’ll figure out if I should do something with these, but they are still making money so…

Non-retirement savings: $15,500. I’m good at saving! I’ve used a lot of my savings to go to grad school so there was more, and I’m hoping to take a post-grad trip to Spain and MAYBE I’ll use it for a down payment on a house? Maybe I should invest it? I’ll need another grad degree to figure how to do that.

Checking: $1,150. I pay for everything with the credit card mostly so that I don’t have overdraft issues.

Miscellaneous things: My health! My cat! My partner! My functioning brain! My incredible co-workers! My helpful classmates! My slowly growing community of friends (we moved here three years ago)! My white privilege! (Note: This is not an endorsement of white privilege as a good thing, but it is an asset to be used to build power for those without privilege.) The fact that we can afford a one-bedroom apartment making very little money! …oh and like probably $3,000 worth of vinyl records and stereo equipment because I used to DJ.

Monthly Income

Paycheck amount: $1,125 paycheck every other week after tax and deductions. That’s $22.50 per hour or $28.08 per hour pre-tax/deductions—I work 25 hours a week cuz grad school.

Monthly Expenses

Rent: $1,095 for an 800-square-foot, 1-bedroom apartment without a parking spot. It’s palatial to us. For comparison, we moved here from L.A. where we were paying $1,350 for a 450-square-foot studio apartment… without a parking spot.

Utilities:

- Electric: $35-$55 depending on the season

- Gas: $37

- Phone: $70

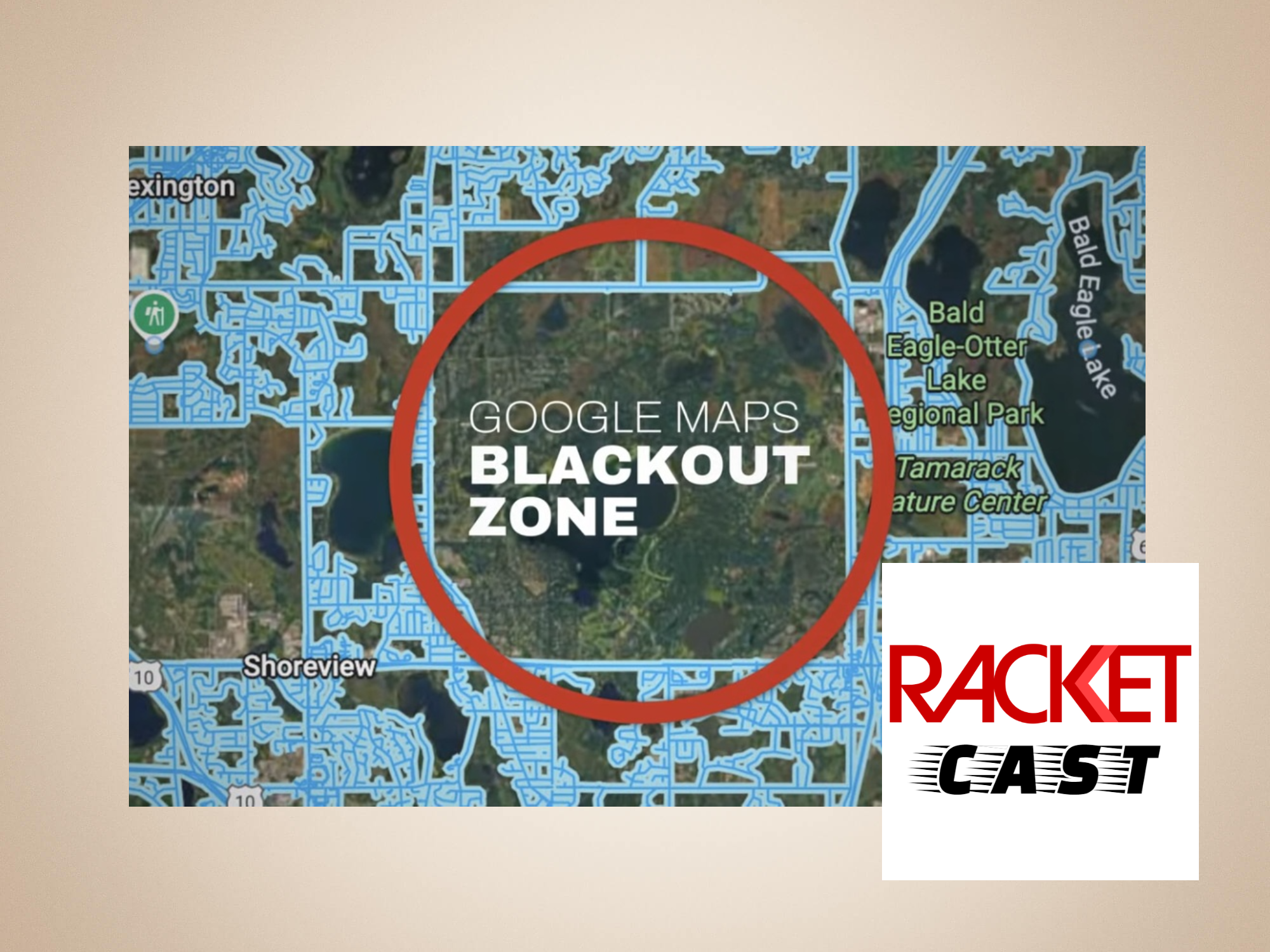

- Internet: $68.50. We have USI fiber internet that comes from the wall, and there are cheaper options, but a) I HATE Xfinity/Comcast, etc., and b.) I am paying this much because I believe internet access should be a public utility just like any other, re: subsidized if you can’t afford it.

Insurance:

- Health: $0. I LOVE MINNESOTA STATE HEALTH INSURANCE. They pay for everything, especially preventative care, so I get free acupuncture, talk therapy, eye exams, dental exams, check-ups, consultations, etc. I hope that bill HF96 working through the state legislature right now gets passed, which would expand MinnesotaCare to all residents!

- Dental: $0 (see above)

- Renter’s: $16.70

- Life: $20.70

- Car: $0, partner covers

Retirement: Grad school and part time job means basically nothing on this front at the moment.

Gas/transportation: Partner covers the car, and my employer helps pay for my public transportation pass, so that’s only $7!

Groceries: Partner covers it! (Lately it’s been upwards of $500–we never eat out.)

Pets: Averages out to $60 for on old kitty with thyroid issues.

Subscriptions:

- Netflix: $0 (brother’s account, though soon this will go away, I hear)

- HBO: $0 (sister’s account)

- Amazon Prime: $0 (partner’s parent’s account)

- Shudder, Criterion: $0 (partner’s accounts)

- Disney+: $0 (bundled with phone bill)

- Hulu/Showtime/Spotify: $6 (special student rate)

- Apple Cloud storage: $8.50

- Racket: $5 [Ed. note: Hell yeah]

- Democracy Now!: $5

- Minnesota Reformer: $5

- Patreon: $10. This changes all the time, but right now I’m supporting The Best Show with Tom Scharpling and The Greedy Peasant—both highly recommended.

- Dollar Shave Club: $8.60 [Ed. note: They should call it the damn $9 Dollar Shave Club.]

- Adobe Creative Cloud: $10

Memberships/annual things:

- NYTimes crossword app: $65/year (an indulgence)

- Nintendo Switch Online: $20/year (for endless Tetris and Dr. Mario gaming)

- MIA membership: $60/year (you get to go to the exhibitions as many times as you want!)

- Contacts without vision insurance: $260/year (I have bad eyesight)

- Minnesota State Parks pass: $35/year (trying to actually get outside)

- (Can you tell I feel I need to justify all these things?)

Money Talk Q&A

Did your family talk about money growing up?

Not really. We still speak in vague terms about money even though everyone in the family is now an adult. My parents both come from blue-collar families–my grandparents were steel workers, post office employees, waitresses–but they have done well for themselves through various means. My dad was in construction his whole life, and he worked with costs and numbers, so with his knowledge and skill set he has done well with the houses he’s bought and sold and the real estate he’s invested in.

Growing up, I knew his financial situation was improving, but I know nothing else. He has sort of talked in generalities, but I think he firmly believes in that great Midwestern edict: Mind Your Own Business. I do know he is very proud of the fact that he never asked his parents for a dime. I have had to ask for help occasionally, but basically everyone I know in my age range gets help from their parents, so I don’t think it’s just me, and I don’t think this is just my generation. Real wages have not gone up IN OUR LIFETIME. Overall, I wish he would talk to me about things like how to buy a house, how to invest, etc., but I don’t ask because it’s a too dangerous of a psychological bog in which to wade.

Did you worry about money growing up?

Yes and no. My parents struggled for the first few years of my life, but by the time I was old enough to know what was going on, things were fine. Then my parents got divorced when I was nine and though my dad continued to be fine, my mom struggled to raise three kids on her own even with alimony. I was the oldest, so I tended to be more concerned with the situation, and I would get mad at my mom for complaining that her job didn’t pay enough while insisting she needed to buy her dishes at Pottery Barn instead of Target. I have kind of always been a 40-something year-old.

At what age did you become financially independent?

I guess, like other contributors, financial independence is not something I think is possible, nor desirable, and I don’t just mean getting money from your parents. I’ve worked in nonprofits my whole life, so profit, wealth, and trying to make the most money you can is just antithetical to my value system. The idea that we all should try to live absolutely financially independent from one another is so wrong-headed and ultimately not possible. It’s the same thinking that ends up creating gated communities filled with couples in giant houses who are miserable but think that they’ve “made it." I’d rather rent for the rest of my life and ask for help from friends and family when I need it, knowing that they will be asking me for help when they need it, with the understanding that that is what a community is. Reciprocity, mutual aid, community ownership, collective economic systems–these are the ways we are going to get through the ongoing nightmare of global warming-created (aka capitalism-created) crises.

To answer the question, though, I have been mostly financially independent since I graduated college in 2003; however, even when I have been financially independent, I know the fact that I have been able to get several thousand dollars from my dad when I need it means I have not had accruing debt, which means I can then live financially independent. I try my best and mostly succeed at not asking for money. Considering the cost of living and terrible wages etc., I think I do pretty okay.

How did you learn how to budget your life?

My dad was an estimator, that was his job, so from the time I was a little kid he was showing me how to estimate costs of things. I never got a formal lesson in budgeting; it was through a sort of osmosis that I picked it up. There were always sheets of paper all over the house with nouns and financial figures all over them, estimating the costs of repairs, renovations, TVs, insurance policies, you name it. Thus, I have had a running budget spreadsheet since I was about 16 years old. I don’t use it to dictate my life, it’s kind of the other way around: “This is what I want to be able to afford in my life, how do I get to be able to do that?” I try very hard to spend money locally, independently, and on friends’ projects. I indulge in big things occasionally, but only after thinking hard and doing like 20 budgeting spreadsheets to work everything out.

Have you ever received inherited income, major financial gifts, or large insurance payouts?

Yes. I have been given several cars in my life, which were all my dad’s old company cars. My dad paid for my undergraduate degree ($24K at an in-state school), and has given me $10K three times in my life when I needed some help. Those three times I needed help were when I was either unemployed and having a hard time finding a job or making very little money, so that covered my life for a few months each time. My grandmother gave my dad some money when she passed, which he then split among me and my siblings, $30K each. But nothing ongoing. I’m sure some people look at those amounts and would call my situation extremely privileged and wealthy, while some people would say that’s barely anything at all. Both are probably true.

Do you worry about money now?

Yes and no. Overall, I can afford my life in Minnesota, which is good. That life, however, is pretty bare bones—we rarely do anything, we don’t take any trips, we don’t go to concerts, we don’t go out to eat and only occasionally order in—a lot of that is because we are still acting like there is a pandemic going on, because there is. Once I graduate, we’ll see if I get some great job. Frankly, I’m not looking forward to it. The whole idea of getting the grad degree was that I could get some better job, but going to grad school has made me wanna go live in the woods on a commune or something.

If I had a lot more money, it would probably mean I would have a lot more responsibility (aka stress), and a lot less time to do things like look at trees and walk to the lake and drink coffee on the couch all morning. So, what I would like is to find a job that pays me enough to do a few more fun things on a regular basis, but that does not cause me to want to poke my own eyes out. Oh, and to find a place with a goddamn dishwasher.

How much do you think a person or household needs to earn to live comfortably in the Twin Cities?

The most I have ever made at a job was $52K/year. That was back in 2017 and I felt like I was a damn queen because I could afford to buy any used record I wanted, I could afford to not have to stand in the grocery store aisle doing comparative math, and I could occasionally go visit my friends in other cities—on a plane and everything! I also felt like that was the absolute minimum anyone should be making. We should all feel like our basic needs are met and that we have a little breathing room for small indulgences AT LEAST. According to the internet, $52K now would be about $64K/year or $30.75/hr. for 40 hours a week. We could bump that up to $68K-$70K, and that sounds about right… for one single person. Double that for two, quadruple it for a family, etc.

Money Journal

Day 1

Nothing!

Day 2

1:30 p.m.: Amazon for 2 pairs of shoe traction thingees and a big bag of rooibos tea. I am not proud of the fact that my first purchase in this journal is from Amazon, and spending $70 is a LOT for us, but my partner fractured a rib slipping on ice in January, and there’s a blizzard coming, so I said “fuck it”–we’re not going through that again. $71.23.

5 p.m.: Pizza Lucé. I had no time to cook before class and Lucé is super fast and good, and we can eat the leftovers tomorrow. $26.96.

Day 3

10 a.m.: Bandcamp. Bought my friend’s new album. $7.56.

Day 4

Xcel electricity bill (down from last year!). $42.32.

Day 5

Nothing!

Day 6

9:45 a.m.: U of MN school store. Had to grab a Luna bar before my three-hour class. $2.15.

1:30 p.m.: Hard Times Café. Lunch at Hard Times is like going back in time to 1995 when I was a teenager drinking fancy lattes at the local college coffee shop trying to learn my lines for my scene study class while Guided By Voices plays over the second-hand stereo system. It’s pure Gen X '90s and I fucking love it there. $10.

Day 7

U.S. Internet monthly bill. $68.64.