Welcome to Racket’s new Money Journal series, where you can snoop on the finances of an anonymous Twin Cities neighbor. Interested in submitting your own? Email jay@racketmn.com for instructions on over-sharing the monetary details of your life! H/T to Refinery29 for pioneering a tremendous concept that we’re excited to localize.

Job: Community Organizer

Age: 24

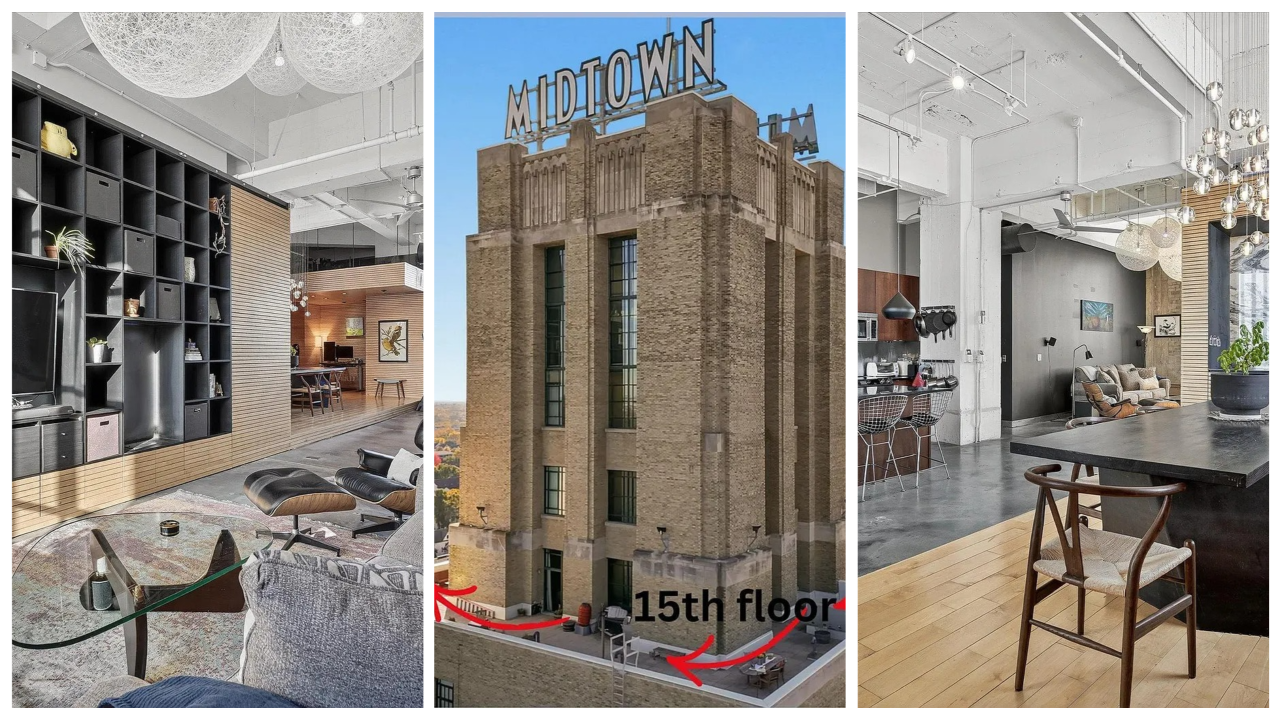

Neighborhood: Whittier

Education: Bachelor’s Degree

Salary: $44,000

Partner’s salary: N/A

Estimated net worth: No debt; $7,000 in a cash savings account; $38,500 in stocks/ETFs; $11,500 in a Roth IRA; $4,500 in a work retirement plan; about $14,000 in stuff I could sell and live without if I needed to (like 75% of that being my car). Total: Around $75,500.

Debt

I am crazy lucky and have no debt.

Monthly Expenses

Paycheck amount: $2,700 per month after pre-tax deductions and taxes.

Family assistance: I am still on my parents' phone plan and car insurance which they pay, along with using their Netflix and Apple+. This comes out to around $115 of stuff per month they still pay for me.

Rent/mortgage: $642 monthly, which covers rent and all utilities. I live in a three bedroom—really a two bedroom and sunroom that we use as a bedroom—with two roommates.

Insurance:

- Health & Dental: I have a low-premium, high deductible health insurance plan. My work covers the monthly premium and I put $168 pre-tax a month into a health savings account. That account has $1,092.

- Life: N/A

- Car and house/property insurance: $0. As mentioned I don't pay my car insurance. I've had renter's insurance in the past—I don't currently.

401K/retirement: I contribute $220 pre-tax monthly, my employer contributes $366 monthly.

Phone: $0. As mentioned, my parents pay for my phone bill.

Car: My 2012 car was given to me in 2020 by my parents after my grandpa got too sick to drive anymore and my dad got his car. I try to bike as much as I can because I despise how angry driving makes me. But damn if cars aren't convenient as hell in this town of subpar public transit, so I usually get by with refilling my car around once a month, which is currently like $45.

Food: $300 for groceries and eating/drinking out. The thing I most often find myself spending extra money on is getting food delivered. I also make a conscious effort not to be cheap when it comes to other people because I don't want to be a dick, so I try not to ask for people to pay me back on shared meals, and having worked in the food industry I tip 20% minimum on everything.

Subscriptions:

- Spotify: $10.79

- Xbox Game Pass Ultimate: $16.18

- AMC Movie Pass: $23.60

- YMCA Membership: $36.50

Money Talk Q&A

Did your family talk about money growing up?

Very little. It took me until high school to realize that we were an upper-middle class/rich family. For most of my childhood, my mom was an executive in corporate America, working 60-80 hours a week, and my dad was a stay at-home parent. In high school, my mom took a less demanding job and my dad re-entered the workforce. I've never been told exact numbers, but based on what I know, my family's average yearly income was/is around $150,000-$250,000. I attribute taking so long to understand that our family was not normal to the fact that we never talked about money and that we lived below those means. We lived in a nice but pretty standard south Minneapolis house, I went to public school, and other than necessities (food at home, basic clothes, education expenses), once I was in high school it was up to me to earn any money I wanted to spend.

Did you worry about money growing up?

Almost never, and the worries I did have came from my lack of understanding about our financial situation and seeing friends with real struggles. Growing up during the 2008 housing crisis, I would sometimes worry about that happening to our family, but we were never at risk of losing our house—my parents ended up paying off their mortgage early. In high school, I was somewhat worried about student loan debt but when I started having conversations about college with my parents, they made it clear that they had saved a significant amount of money and their goal was for me to leave college debt-free.

At what age did you become financially independent?

I still get stuff like my car insurance and phone payments from my parents, so I don't know if I am technically independent now. But I would say after graduating college at 22 and beginning to work full-time was the first point where I had the ability to survive without the help of anyone else—I've just continued to take additional support that my parents were willing to give me. I've had a job since I turned 14 to do stuff like eat out, buy Magic the Gathering cards, and save.

How did you learn how to budget your life?

I'm gonna sound like an asshole, but I have just always been obsessed with saving money. I live very frugally, I use stuff until it falls apart, and I love the feeling of putting money into savings/investment accounts. So the minute I started making money, I got really into making sure I knew exactly how much I was spending and where my money was going. As I've gotten older, I make a habit of checking in on my credit cards and bank statements regularly. Also, I have a ton of really great safety nets in my life, so I acknowledge that my budget has never really been put to the test of things like figuring out how I am going to eat or make rent.

Have you ever received inherited income, major financial gifts, or large insurance payouts?

Yes. My family paid for my entire college education, including housing and food. I went to a state school, so in total I believe that gift would be about $90,000. My parents gave me a car that they no longer needed and have told me I can sell it at any time and keep the money; when I got it the car was worth around $9,000. I've received inheritances, one of $4,000 and another of $1,500—I invested the entirety of both. I haven't received them, but have also been told by several family members that they bought stocks and bonds in my name when I was born and can be used at any time for a "big life purchase"—house down payment, wedding, kids, etc.

Do you worry about money now?

I'm a very anxious person; I worry about most things. My money worries are mostly about if I am doing the right thing with the incredible life position I have been given. I hate the stock market and think the fact that to get/maintain financial success that you basically have to participate is a terrible part of our financial system. Its volatility and the fact that the system is set up to benefit huge brokerage firms and give no protection to retail investors scares me, but I still participate in it and currently see it as my best option to have the most financial flexibility in my future. I've considered buying a house, but for a number of reasons (terrible interest rates, being young, wanting flexibility in where I live), I have decided against it.

On a day-to-day, I am not worried about not having enough money to live; I know that I have enough safety nets to protect myself from most things. Because of my obsession with saving money, I do have times where I feel like I am spending too much money because it takes away from my ability to save more.

How much do you think a person or household needs to earn to live comfortably in the Twin Cities?

I think this completely depends on how much debt the person or household has. If you're like me and are lucky enough to have no debt, I think a single person could comfortably live on anywhere between $40,000 to $50,000 depending on what your hobbies or things that make you happy are. Like, I generally love living with roommates, so that benefits me. If I needed a studio apartment to feel comfortable, my rent would be 40-50% higher. From that baseline, I would say add whatever debt payments a person needs to make on top of that. I am going to be honest, I have no idea what it costs to have kids, but all I know is it is a lot. I'm going to guess that a family of four without debt in the Twin Cities needs like $75,000 to $85,000 to live comfortably. Again, add needed debt payments on top of that.

Day 1

Nothing.

Total: $0.

Day 2

7 p.m.: I got Taco Bell delivered $19.78.

Total: $19.78.

Day 3

Nothing.

Total: $0.

Day 4

Nothing.

Total: $0.

Day 5

12:30 p.m.: I've had new clothes for the gym sitting in an online shopping cart for about a month. I finally remembered to buy them. $42.03.

12:45 p.m.: I got Jimmy John's delivered. $19.84.

Total: $61.87.

Day 6

7:30 p.m.: I went to Target to get groceries and a few cleaning things for my apartment. I would have bought beer if the liquor section didn't close at 6 p.m. (C'mon Minnesota we gotta get our stuff together.) $60.37.

Total: $60.37.

Day 7

Nothing.

Total: $0.

Weekly total: $142.02

I would say this is a pretty typical week for me. It's missing maybe one more meal out, going to the liquor store, or one random other purchase but other than that, this is typical.