Personal Info

Welcome to Racket’s Money Journal series, where you can snoop on the finances of an anonymous Twin Cities neighbor. Interested in submitting your own? Email jay@racketmn.com for instructions on over-sharing the monetary details of your life! H/T to Refinery29 for pioneering a tremendous concept that we’re excited to localize.

Job: Librarian

Age: 32

Neighborhood: Bottineau in Minneapolis

Education: Master’s Degree

Salary: $65,000

Partner’s salary: Varies, $1,600 this year

Estimated net worth: $35,000 (includes savings, car, retirement, etc.)

Debt

None.

Monthly Income

Paycheck amount: $5,040 (before taxes, etc.)

Monthly Expenses

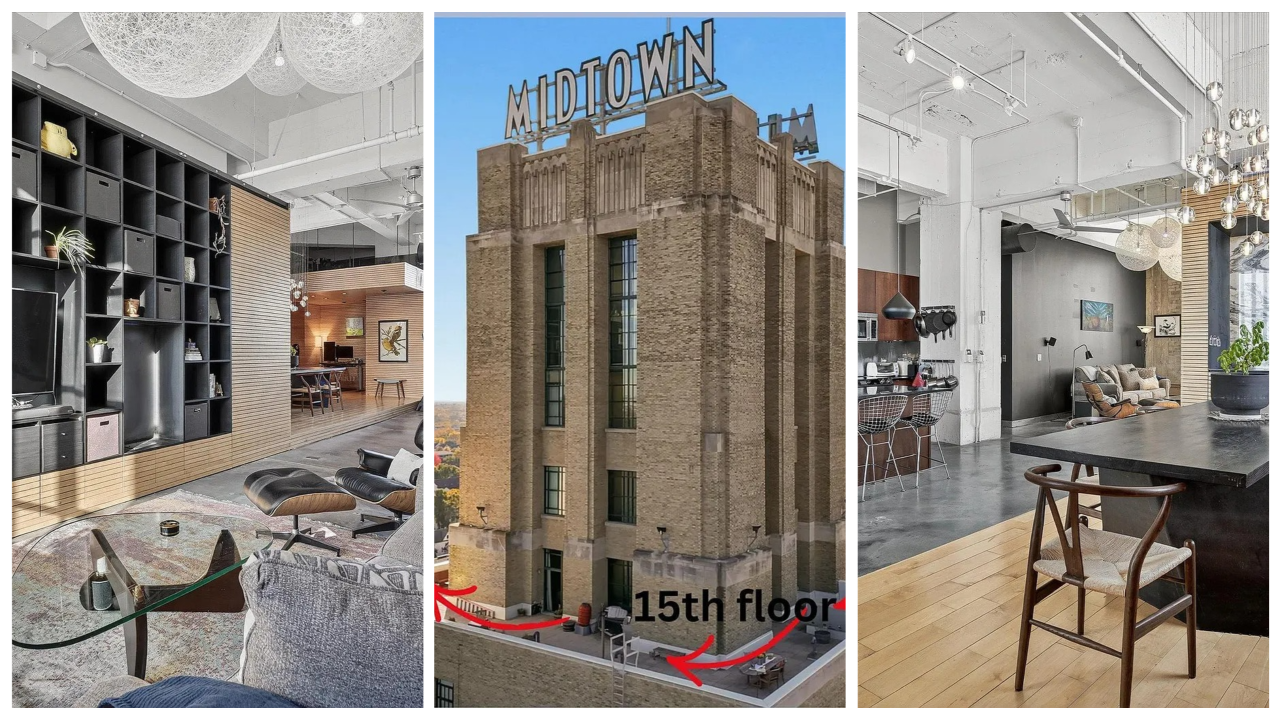

Rent: $1,700

Internet: $126 (love this city’s internet duopoly)

Phone: $81

Insurance:

- Health: $55

- Dental: $25

- Life: $25

- Bundled renter’s insurance and car Insurance: $100 (two drivers, one car)

Union Dues: $50

Retirement: $170

Subscriptions:

- Disney+

- Dropout

- Netflix

- Racket [Editor's note: Hell yeah.]

- MN Tool Library

- AMC Movie Pass

Money Talk Q&A

Did your family talk about money growing up?

Yeah, but only broadly. My family’s money lessons boiled down to the following: You should start working young (I started my first job at 13), save as much money as you can, and avoid loans/using credit cards (all pulled from the immigrant parent’s handbook I think). I think those lessons really impacted my life in both good and bad ways. I’m grateful that I started working young because I really needed the self-discipline (and money). But I feel like I went overboard with my caution toward loans as I’ve never taken a loan and I will need to at some point.

Did you worry about money growing up?

No. Sure, there were times I was jealous about the expensive gifts, concerts, and Disney vacations my friends got but I didn’t grow up needing anything important.

At what age did you become financially independent?

Twenty-five. Becoming a librarian is expensive (shocking, I know) and paying for school out of my pocket without loans was tough. I only managed it by juggling three part-time jobs, getting scholarships, and living with family members until my mid-twenties. When I turned 25, I had a full-time job as a librarian and could move out debt-free. Sometimes I wonder if I would make those choices again if given the chance but then I hear horror stories from friends about their student loans. I don’t think my anxiety would be able to handle that.

How did you learn how to budget your life?

Paying for college was the ultimate crash course in budget making because it made me look at my cash flow which then forced me to focus on the things that were a higher priority like college classes, textbooks, bus passes, and food. Everything else (everything fun) got mostly zeroed out. I’m still learning because I’ve got huge gaps of knowledge related to retirement funds and getting a mortgage.

Have you ever received inherited income, major financial gifts, or large insurance payouts?

I have not received any insurance payouts or have inherited money. I’ve been lucky to get airfare from my parents a couple times to visit family elsewhere.

Do you worry about money now?

Oh yeah. I feel like we are years away from getting a home, especially since we want to stay in the neighborhood. Saving for retirement is another anxiety but it is not in front of my mind at the moment. Logically I know that I shouldn't, but I often compare where I am with other people my age and see they have a home they are already paying off which makes me feel like I’m spinning my wheels.

How much do you think a person or household needs to earn to live comfortably in the Twin Cities?

With no kids or debt I think $65,000 is a pretty good place to be but that number would go up exponentially if you had dependents or loans.

Day 1

8:30 a.m.: Bought bags of dry food from the vet for the cat. $33.90.

11 a.m.: Moon Palace Books. Christmas shopping. $41.00.

11:15 a.m.: Uncle Hugo’s. Impulse purchase AKA Christmas shopping for me. $14.00.

12:15 p.m.: Turtle Bread for lunch. $25.51.

7 p.m.: Loaded money to the bus card. $20.00.

Total: $134.41

Day 2

Nothing.

Total: $0

Day 3

5 p.m.: Cub Foods delivery. My partner and I actually enjoy grocery shopping together, but this is a much busier workweek than normal. Able to get 20 dollars off the purchase with a discount code. $88.10.

Total: $88.10

Day 4

Nothing.

Total: $0

Day 5

Nothing.

Total: $0

Day 6

9 a.m.: Breakfast at the Buttered Tin. $28.89.

Total: $28.89

Day 7

8 a.m.: Holiday: Weekly fillup of the car. Used a 40 cent off per gallon coupon. $32.89.

6:50 p.m.: Khun Nai Thai: We both gave up on making dinner and got delivery from our favorite Thai place. $76.96.

Total: $109.85

Weekly total: $361.25

This is a pretty average week for us. We love going out to eat or getting takeout and do that maybe 2-4 times a week. On the days where we didn’t spend anything, we are just working and then coming back home. Being homebodies who like reading, watching Netflix or Dropout and playing with pets means we don’t rack up many daily expenses.

Not going to lie, it felt weird compiling all this info to share with strangers online via the Twin Cities’ premier media outlet but I’m glad I did it. I hope this was informative.