Money Journal: 1 Week In Minneapolis’s Whittier’s Neighborhood On a $96K Salary

How far do the dollars of a 35-year-old lawyer go?

8:24 AM CST on December 12, 2022

Welcome to Racket’s Money Journal series, where you can snoop on the finances of an anonymous Twin Cities neighbor. Interested in submitting your own? Email jay@racketmn.com for instructions on over-sharing the monetary details of your life! H/T to Refinery29 for pioneering a tremendous concept that we’re excited to localize.

Job: Government lawyer

Age: 35

Neighborhood: Minneapolis's Whittier neighborhood

Education: Law degree

Salary: $96,000

Partner’s salary: $72,000

Net worth: $221,000

Assets

Property: $88,000 in real estate equity (a home and a rental apartment)

Savings: $44,000 in cash and stock investments; $69,000 in pre-tax retirement; $20,000 in after-tax retirement

Debt

Mortgages: One on the house, one on the apartment.

Monthly Income

Paycheck: $5,800 after taxes

Rental income: $1,575

Monthly Expenses

Home mortgage: $2,650 (I pay $1,450, my partner $1,200)

Rental expenses: $1,630 (I became a landlord kind of unwittingly—as you can see, I’m not very good at it)

Retirement: $1,025 (my job adds another $500)

Groceries: $500

Utilities: $260 split two ways

Transportation: $83 for a work-discounted bus pass, $20 earmarked for bike repairs, and $8 for a NiceRide membership

Donations: $80

Internet: $60 split two ways

Health and dental insurance: $48

News and app subscriptions: $45, including The Racket [Editor’s note: Hell yeah]

Cell phone: $39 (call your provider and ask for a lower monthly payment—they’ll do it)

TV/streaming: $0 (I’ll go Dr. Bronner bottle on this if you give me a platform. “Throw TV out window!!—Free mind from corporate anesthetic mesmerism!!—All one!!”)

Money Talk Q&A

Did your family talk about money growing up?

Sort of. My childhood was… unusual. My parents divorced when I was six. My dad came from old blue-blood stock and worked 24/7 to stay upper-middle class. I didn’t see him much. My mom, however—who had no college, no desire to work, and mental illness of the hard and unsympathetic variety—fell into destitution after the alimony ran out. My childhood was evictions, power shut-offs, begging for money, Cheetos for dinner, life lived under the quiet roar of poverty—and then brief respites to our dad’s for family dinner, backyard soccer, sleepovers, trips to the family cottage. To answer your question, there were never conversations about how to open a bank account, how interest works, and so forth. But lacking money was life’s defining feature. We didn’t have money for rent, food, clothes, gas, Christmas. In 6th grade my mom put a $20 bill on the table, told us it was the last we had, and asked what we should do with it. That was the money talk. (We got Domino’s.)

Did you worry about money growing up?

Every day, as anyone in poverty will tell you. My mom would beg and borrow $1,000 for a security deposit and a month’s rent, use a fake name on a rental application, and then never pay another dime. We were constantly ducking landlords, though having kids in the house was sometimes enough to beg off eviction for a bit. We’d get maybe six months before the pink slip. The day before the sheriff was scheduled to throw us on the curb we’d start making calls and knocking on doors until we found someone to put us up—grandma “one last time,” an old family friend, once a stranger my mom met at a coffee shop—until we’d overstay our welcome and get told to beat it. Rinse and repeat. For me, being poor involved moving overnight and leaving behind possessions and friends and schools without a word, a few times a year. You can imagine a kid living like that was somewhat preoccupied by money.

I ran away when I was 15. After that I found myself—a touch surreally—with the ordinary cash problems of a corn-fed middle class teenager. Had I banked enough dough working at the gas station over the summer to quit for the school year? Could I clock enough overtime this paycheck to justify buying the new Pokémon? Can I really afford to supersize these fries? Slowly I came to the idea of the future. Should I go to college one day? Have a career? Should I be planning for this? Who and what do I want to be? When you’re poor these questions arise only with difficulty.

At what age did you become financially independent?

The day I graduated law school at 24.

How did you learn how to budget your life?

After graduating I was broke. I was making $40,000 a year doing public interest work, but law school—even with a scholarship and at a public university—had cost a cool $80,000 in private student loans. The numbers didn’t really work at first. I only had a few hundred bucks left after loan payments and rent, and my little bank account balance was inching in the wrong direction. For a few years the spine-tingling terror of poverty was one paycheck away. Things were dire enough that I sometimes stole food from the grocery store.

At some point I knew I needed to sit down and sort the math out, or else. I started reading about how to make and stick to a budget—stuff you find Googling “make budget how??” And I really committed to it. It was very uncomfortable at first. The numbers were very tight. It took me over a year to save up a few grand for an emergency fund. I saw one matinee a month—no popcorn. I got familiar with the library and other freebies around the city, to which I owe City Pages’ Freeloader Friday a debt of gratitude. No plane tickets, no vacations, nothing. Some of my less sympathetic friends called me cheap. But under the hood it was adding up.

After a few years and a few raises I got a job digging through other people’s finances and ruthlessly fixing their problems. “Nice to meet you. You can’t afford your house or your truck which, by the way, you’re thirty grand underwater on. Sell the house, call the repo man, and file for bankruptcy immediately.” Those kinds of conversations. For five years I stress-tested thousands of household budgets, encountered every conceivable kludge and configuration, saw every variation on human tenacity and miseducation and delusion gamed out over lifetimes. You learn some things doing that. I could make you 10 perfect budgets before breakfast.

Have you ever received inherited income, major financial gifts, or large insurance payouts?

Yes. My dad covered my college tuition (~$25K total for a state school, ‘05-‘09) and my rent through college (~$28K). It’s part of the deal in his family: Your parents get you through undergrad, but after that you’re on your own. He broke the rules and paid my rent in law school too though (~$20K). I’m very lucky.

Do you worry about money now?

Sure, but differently than when I was broke. When I paid off my student loans at 30 everything flipped. That $800 in my bank account suddenly became thousands of bucks a month in surplus cash. Things changed quickly. I wrote up a list of everything I had been denied—a new mattress and bedspread, a big winter coat, a nice couch, a nice laptop, good cookware, glass champagne flutes, a record player, a Japanese rice cooker, an array of hot sauces, every little luxury I could think of—and splurged for about three months. After that I built a $15,000 rainy day fund and started dumping money into retirement. I saved up a down payment and bought a condo, then bought a house a few years later. (I rent out the condo now at cost; it was my first home and I have sentimental attachment to it.) By then I was making $115K/year in private practice, but I got offered a dream job working for the public and had the flexibility to afford the pay cut.

Now instead of petty cash problems I get to deal with big-picture cash flow management. As you get more money the time span of your concerns expand. I know the mortgage will get paid, that retirement will get funded, that cocktails and yoga class and fancy co-op groceries and one or two domestic vacations per year are within the budget. The questions now are: do I have enough coming in over the next year to easily pay for a new furnace out of pocket, or will I need to tap my rainy day fund? How much will a vacation this winter set back our half-baked plans to renovate the patio? Don’t get me wrong, it can still be stressful—but it beats dry Cheerios for dinner.

How much do you think a person or household needs to earn to live comfortably in the Twin Cities?

After this last year of inflation I’d say $75,000 for one person, $130,000 for two, and an extra $15,000 per kid.

Day 1

8 a.m.: Scheduled monthly donation to a charity. $10.

10:30 a.m.: Christmas shopping for [redacted]. Got a [redacted] half off! $74.95.

7:30 p.m.: Every Wednesday we try to do something a little special—it’s a Swedish concept called Lillördag, or “Little Saturday.” Met at the Prodigal Pub for dinner and drinks. $26.81.

Total: $111.76

Day 2

9:45 a.m.: Oat milk latte at the office. $5.81.

12:30 p.m.: I usually bring lunch from home, but once a week I’ll get something fancy downtown. Green + The Grain. $14.74.

3:30 p.m.: Target trip for household items. $66.40.

Total: $86.95

Day 3

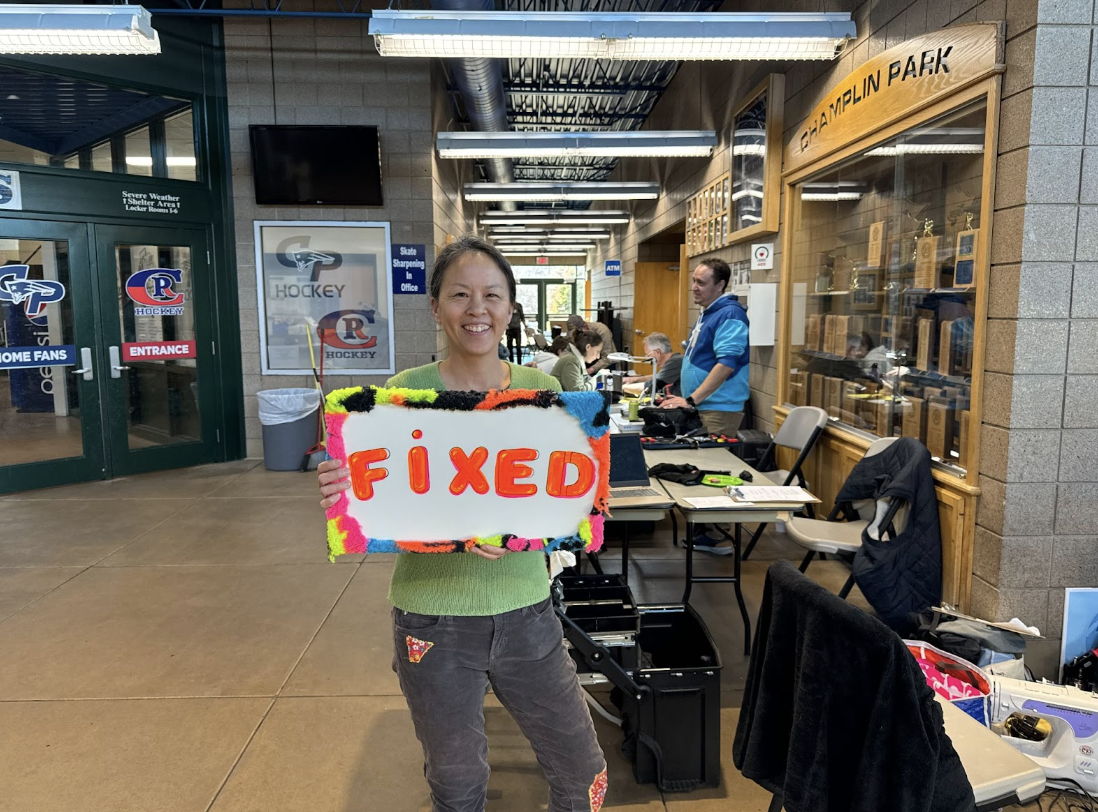

2:15 p.m.: Got a favorite pair of jeans repaired at Sew Simple. $16.20.

Total: $16.20

Day 4

9 a.m.: Gas bill due today. $43.50.

10:45 a.m.: I got family coming to town soon and we want to make waffles. One waffle iron, $20.

1 p.m.: Class at Yess Yoga using a bulk package I bought on sale. Normally $18, today only $10.

3:30 p.m. Crossed the street to the Prodigal Pub to watch Argentina beat Australia. Fries and a beer. $14.26.

8:15 p.m.: It’s our anniversary. Celebrating with dinner and drinks at Khâluna. $110.33.

…and the Uber. $7.98.

Total: $162.57.

Day 5

11:45 a.m.: Take-out grub from Common Roots. $21.38.

1 p.m.: Picked up some groceries for the week at the Wedge, Truong Thanh, and Colonial Market. $70.89.

7 p.m.: Met some friends at Reverie for dinner. Special: Muddy Waters’ mock duck tacos. $29.82.

Total: $122.09

Day 6

Nada.

Total: $0.

Day 7

Internet bill due today. $30.

Total: $30.

Weekly total: $529.57

Read More:

Stay in touch

Sign up for our free newsletter

More from Racket

Freeloader Friday: 80 Free Things To Do This Weekend

Record Store Day concerts, 420 parties, clothing swaps, and group bike rides.

Barnard College Demonstrates Commitment to Free Expression by Suspending Isra Hirsi for Protesting

Plus school district drama, another union Starbucks, and Lake Chipotle 2.0 in today's Flyover news roundup.

Meet David and Goliath: Best Friends, Minneapolis Sidewalk Celebrities

Cities thrive on characters, and these matching buddies are getting noticed all around town.

My MSPIFF So Far and Everything That’s on the Big Screen Right Now

Pretty much every movie you can catch in Twin Cities theaters this week.

Soon You Can Repair Your Computer in MN Without Apple’s Permission

Step aside, planned obsolescence: This July, a new state right-to-repair law will make fixing electronics easier.